Beyond the Budget: Why Emotional Intelligence is Your Secret Weapon in Wealth Building

Uncover why emotional intelligence is the key to making smarter financial decisions and building lasting wealth.

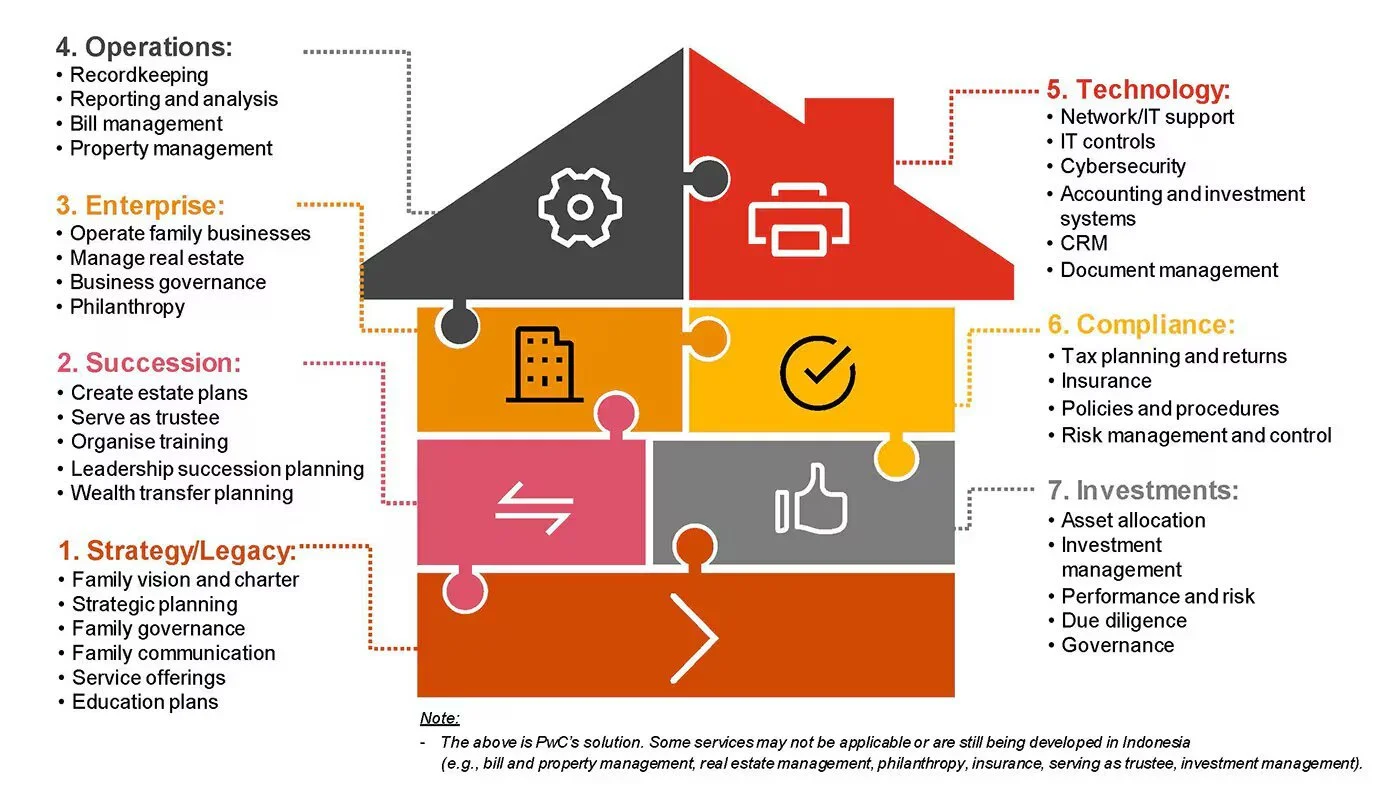

The Modern Family Office: Revolutionizing Wealth Management for Everyday Business Owners

Explore how the Modern Family Office concept is reshaping wealth management for everyday business owners and professionals.

The Athlete's Mindset: Applying Sports Psychology to Your Financial Game Plan

Learn how to apply an athlete's mindset to your finances and achieve your wealth goals with a winning strategy.

Redefining Wealth: Why Your Financial Journey is More Than Just Investment Returns

Discover why wealth is about more than just numbers and how to focus on what truly matters in your financial journey.

Why Being a Business Owner Sucks (And Why It's Still Worth It): Embracing the Challenges of Entrepreneurship

Being a business owner is tough – it's a 24/7 job with endless challenges. From financial stress to decision fatigue, entrepreneurship can be overwhelming. Yet, it's also incredibly rewarding. At Black Mammoth, we understand the paradox of business ownership. It's about embracing the difficulties while reaping the benefits of freedom, personal growth, and the potential to make a real difference. In this post, we explore why being a business owner can be challenging and why it's still worth it. We offer strategies to thrive amidst the chaos and find fulfillment in your entrepreneurial journey.

The True Definition of Wealth: Why Money Isn't Everything and How to Achieve Real Financial Freedom

True wealth isn't about the size of your bank account. It's about finding happiness, giving back to others, and living life on your own terms. At Black Mammoth, we believe in redefining wealth to focus on experiences rather than possessions. This shift in mindset can lead to greater fulfillment and even improved financial health. By understanding your relationship with money, prioritizing what truly matters, and investing in personal growth, you can achieve a richness in life that goes far beyond monetary value. Join us as we explore the three pillars of true wealth and practical steps to achieve real financial freedom.

Breaking the Cycle: Why Financial Education is the Key to Generational Wealth for Black Americans

Financial education is more than just learning how to balance a checkbook or create a budget (although those are important skills). It's about understanding how money works, how to make it work for you, and how to pass that knowledge down to the next generation.

Here's why financial education is crucial:

It Breaks the Cycle of Financial Illiteracy

Many of us grew up in households where money wasn't discussed. Our parents didn't teach us about investing, credit, or building wealth because they didn't know themselves. By educating ourselves, we can break this cycle and ensure our children have the knowledge they need to build wealth.

It Empowers Us to Make Informed Decisions

When you understand how money works, you're less likely to fall for get-rich-quick schemes or predatory financial products. You can make decisions based on knowledge, not fear or misunderstanding.

The Truth About Debt: How Leveraging Can Build Wealth for Black Americans

Here's the truth: not all debt is created equal. In fact, some types of debt can be powerful tools for building wealth, especially for Black Americans who've historically been shut out of traditional wealth-building opportunities. Let's break it down.

Good Debt vs. Bad Debt

First things first, we need to understand the difference between good debt and bad debt.

Bad Debt:

Student loans (once you're not using that education anymore)

Personal loans

Payday loans

Credit card debt (when misused)

Your primary home (yeah, you read that right - more on this later)

Good Debt:

Business loans

Rental property mortgages

Investment leverage

Credit cards (when used strategically)

Put Your Money Where Your Heart Is: Why Giving Back Should Be Part of Your Wealth Strategy

When we talk about 'true wealth,' we're not just talking about your net worth. It's about having enough cash to live comfortably, actually enjoying your life, making a positive dent in the world, and leaving behind more than just a fat inheritance check. Notice how only one of these is about money? The rest is about living a life that matters. That's where philanthropy comes in.

Ditch the Suit, Keep the Smarts: Why Modern Family Offices Aren't Just for Rich Old Dudes Anymore

Managing your money as a business owner is like juggling chainsaws while riding a unicycle. Fun, right? For years, only the mega-rich had access to family offices - fancy financial babysitters who handled everything. But why should those fat cats have all the fun? Enter the modern family office. At Black Mammoth, we've taken that swanky concept and made it work for regular folks like you and me. No, we won't buy you a yacht, but we'll sure as hell make your financial life a whole lot easier.

Embrace the Wealth Mindset: Play to Win, Not to Lose

Developing a wealth mindset is about embracing a play-to-win mentality rather than playing not to lose. This proactive approach, inspired by athletic strategies, emphasizes continuous growth and seizing opportunities. In both personal and professional realms, playing to win means pursuing goals with confidence, taking calculated risks, and staying committed to your purpose. Avoiding a defensive stance, which stems from fear, prevents stagnation and limits potential. Instead, focus on learning, investing wisely, and seeking professional growth. By maintaining a positive money mindset, you align your actions with long-term goals, ensuring consistent progress on your wealth journey. Remember, true success comes from the relentless pursuit of improvement and the courage to take bold steps forward.

What is a Mutual Fund??

Dive into the dynamic world of investing with our comprehensive guide on mutual funds, stocks, and ETFs. Uncover the essentials of each investment option, their pros and cons, and strategic insights to navigate the financial landscape confidently. Whether you're a novice or a seasoned investor, our bold, compassionate, and educational approach demystifies the complexities of investing, empowering you to make informed decisions aligned with your financial goals.

Embrace Loud Budgeting with Stoy Hall: A Transformative Approach to Financial Well-Being and Home Decor

In a world where financial well-being often takes a backseat to societal pressures, Stoy Hall and Black Mammoth offer a refreshing approach. Loud budgeting empowers individuals to live authentically, merging financial wisdom with lifestyle choices for a more enriched life. Dive into the journey of loud budgeting and how it's changing the conversation around money, decor, and personal values.

Beyond the Horizon: Embracing Travel for True Wealth and Well-being

Discover how investing in travel before you're 30, as advocated by Barbara Corcoran and Stoy Hall of Black Mammoth, can enrich your life beyond traditional measures of success. Learn practical tips for integrating travel into your life and its profound benefits on mental health and holistic wealth.

Embracing the Investment Journey with Confidence

Embark on a rewarding journey towards financial independence and security by understanding your investment "why," diversifying your portfolio, choosing the right investment vehicles, planning for retirement, and minimizing fees. With strategic planning and the right resources, investing becomes a pathway to achieving your financial goals, empowering you to take control of your financial future. Engage with the investing community for insights and support, and leverage tools and guidance from trusted platforms to make informed decisions. Together, let's shape our future on our terms and pursue our financial dreams with boldness and determination.

The Impact of Fees on Your Investments

In the realm of investment, the subtle but significant impact of fees on portfolio health cannot be overstated. These fees, while seemingly minor, can compound over time, drastically reducing investment returns and hindering financial goals. Understanding the types of investment fees—including expense ratios, transaction fees, advisory fees, and load fees—is crucial. Equally important is adopting strategies to minimize these fees, such as opting for low-cost funds, reducing trading frequency, choosing no-load funds, utilizing tax-advantaged accounts, and negotiating advisory fees. This discussion highlights the importance of vigilance against fees to maximize investment returns, ensuring financial security and independence.

Planning for Retirement: Strategies and Considerations

Retirement planning is a pivotal aspect of any comprehensive investment strategy, aimed at ensuring a comfortable lifestyle in later years without reliance on employment income. It involves utilizing various investment vehicles, understanding retirement needs, diversifying portfolios, and taking advantage of tax benefits. Starting early, contributing regularly, and seeking professional advice are essential steps towards building a solid foundation for retirement. This guide delves into effective strategies and considerations to achieve financial security and fulfill retirement aspirations.

Building a Secure Future: Strategies for Effective Retirement Planning

Effective retirement planning is key to achieving financial stability and the freedom to live retirement on your own terms. This involves understanding retirement needs, diversifying investments, and utilizing financial tools for future income. With strategies like investing in 401(k)s, IRAs, mutual funds, and considering annuities, individuals can create a comprehensive plan. Modern family offices offer tailored advice for wealth management, integrating retirement with other financial goals. Staying flexible, informed, and aware of investment fees are critical steps toward a secure retirement.