Embracing the Investment Journey with Confidence

Embark on a rewarding journey towards financial independence and security by understanding your investment "why," diversifying your portfolio, choosing the right investment vehicles, planning for retirement, and minimizing fees. With strategic planning and the right resources, investing becomes a pathway to achieving your financial goals, empowering you to take control of your financial future. Engage with the investing community for insights and support, and leverage tools and guidance from trusted platforms to make informed decisions. Together, let's shape our future on our terms and pursue our financial dreams with boldness and determination.

The Impact of Fees on Your Investments

In the realm of investment, the subtle but significant impact of fees on portfolio health cannot be overstated. These fees, while seemingly minor, can compound over time, drastically reducing investment returns and hindering financial goals. Understanding the types of investment fees—including expense ratios, transaction fees, advisory fees, and load fees—is crucial. Equally important is adopting strategies to minimize these fees, such as opting for low-cost funds, reducing trading frequency, choosing no-load funds, utilizing tax-advantaged accounts, and negotiating advisory fees. This discussion highlights the importance of vigilance against fees to maximize investment returns, ensuring financial security and independence.

Planning for Retirement: Strategies and Considerations

Retirement planning is a pivotal aspect of any comprehensive investment strategy, aimed at ensuring a comfortable lifestyle in later years without reliance on employment income. It involves utilizing various investment vehicles, understanding retirement needs, diversifying portfolios, and taking advantage of tax benefits. Starting early, contributing regularly, and seeking professional advice are essential steps towards building a solid foundation for retirement. This guide delves into effective strategies and considerations to achieve financial security and fulfill retirement aspirations.

Building a Secure Future: Strategies for Effective Retirement Planning

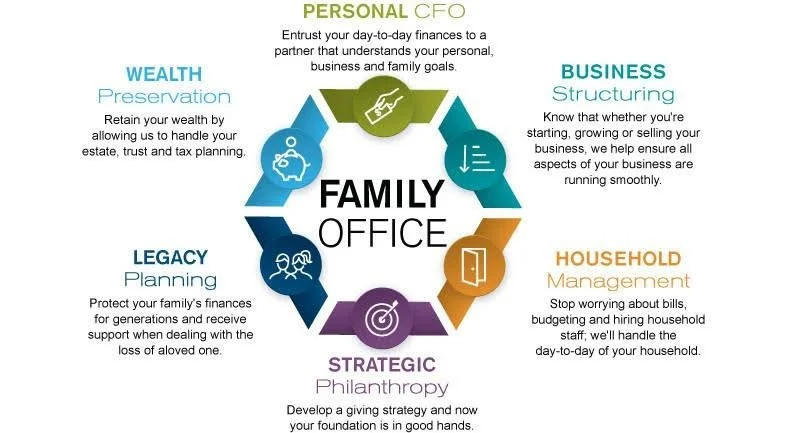

Effective retirement planning is key to achieving financial stability and the freedom to live retirement on your own terms. This involves understanding retirement needs, diversifying investments, and utilizing financial tools for future income. With strategies like investing in 401(k)s, IRAs, mutual funds, and considering annuities, individuals can create a comprehensive plan. Modern family offices offer tailored advice for wealth management, integrating retirement with other financial goals. Staying flexible, informed, and aware of investment fees are critical steps toward a secure retirement.

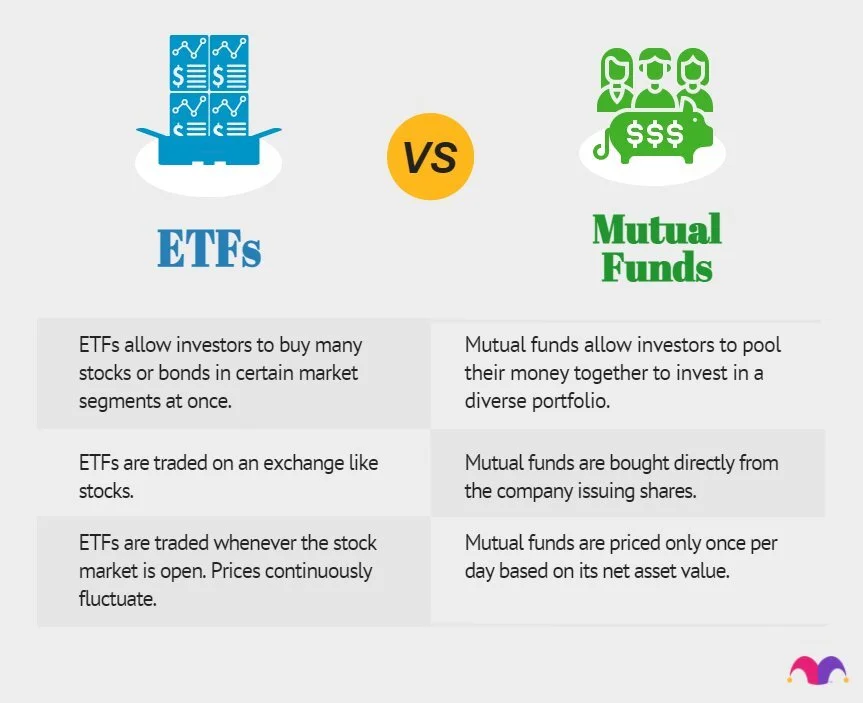

Investment Vehicles: ETFs, Mutual Funds, and Beyond

In the dynamic realm of investing, choosing the ideal investment vehicles is crucial for achieving financial goals. ETFs and mutual funds emerge as prominent options, each with distinctive benefits and considerations. ETFs offer flexibility, diversification, and cost efficiency, trading like stocks and allowing for broad market exposure. Mutual funds, with their professional management, provide a traditional, hands-off investment route, despite higher expense ratios. Vanguard.com and Investipal.co serve as essential resources, guiding investors through the myriad of choices, from ETFs and mutual funds to individual stocks and REITs. The journey to investment success begins with informed decisions, leveraging insights from platforms like nobswealthpodcast.com to navigate the investment landscape effectively.

Smart Investing 101

Investing isn't just for the wealthy; it's a critical strategy for anyone looking to break the paycheck-to-paycheck cycle. This guide strips away the complexity, offering a straightforward path to understanding your investment goals, the importance of diversification, and how to assess your risk tolerance. Whether you're saving for retirement, a dream home, or financial independence, discover how to navigate the ups and downs of the market with confidence. Learn why investing is about more than just money—it's about achieving the life you've always wanted, with practical steps to guide you through Investing 101.

What is a Modern Family Office?

Dive into the evolution of family offices with Black Mammoth, where traditional wealth management meets modern innovation. Learn how modern family offices operate, their day-to-day activities, and the unparalleled benefits they offer to entrepreneurs and high-net-worth individuals seeking tailored financial strategies and legacy planning.

From Scarcity to Prosperity: How Wealth Management Can Help You Tap into Abundance

Are you tired of living paycheck to paycheck? Feeling like there's never enough money to go around? It's time to break free from the scarcity mindset and tap into the realm of abundance. In this article, we'll explore how wealth management can help you achieve financial prosperity and transform your life.

Unlocking the Power of Risk-Adjusted Return: How to Optimize Your Investment Strategy

In the world of investing, understanding risk-adjusted return is crucial for maximizing gains while mitigating potential losses. This comprehensive guide delves into the concept of risk-adjusted return, exploring its importance, factors to consider, strategies for optimization, and real-life case studies of successful investors who have mastered the art of balancing risk and reward.

How to Achieve Financial Freedom

Embark on a transformative journey to financial freedom with our expert guide. Delve into the vital steps of organizing your finances, adhering to disciplined goal-setting, and infusing fun into your financial planning. Uncover the balance that leads to financial security and life's pleasures, ensuring a path to a prosperous and enjoyable future.

Integrating Fitness into Business Success: Insights from Health Strategist Heather Binns

Delving into the insights of health strategist Heather Binns, our latest article unveils how fitness principles can profoundly impact business success. From tailored strategies to fostering resilience, discover how to harmoniously balance your health and professional life for overall well-being and success.

Mastering Debt Management & Credit Building: Essential Strategies for Financial Freedom

Embark on a transformative journey towards financial autonomy with our expertly crafted guide on Debt Management and Credit Building. This insightful resource unravels the complexities of credit scores and effective debt strategies, providing a robust foundation for financial stability and growth. Learn the art of optimizing credit utilization, the nuances of credit mix, and the significance of managing debts. Tailored for proactive individuals, this guide lays out practical steps and wisdom, steering you towards lower interest rates, enhanced credit opportunities, and overall financial empowerment.

Navigating the Cancer Journey: A Guide for Business Owners Facing Diagnosis and Treatment

Facing cancer as a business owner presents unique challenges. Our blog post, featuring insights from experts Rochelle G. Prosser RN, CLNC, and Stoy Hall, CFP®, provides a roadmap for navigating this difficult journey. From understanding treatment options to managing the impact on your business, this guide empowers you to make informed decisions, maintain resilience, and access vital resources like Rochelle's comprehensive cancer treatment library. Discover strategies to balance your health and professional life during this critical time.

What is a Fiduciary?

Dive into the world of financial guardianship with our latest blog post 'What is a Fiduciary?' Learn about the critical role fiduciaries play in managing wealth and investments, their legal obligations, and how they can be the game-changers in your financial strategy. Perfect for business owners seeking clarity and empowerment in their financial decisions.

Good Debt vs. Bad Debt: Strategic Financial Planning for Women and Minorities

Understanding the nuances of good and bad debt can significantly alter one's financial journey, especially for women and minorities. Good debt, when used as leverage, can propel us towards greater financial success, whereas bad debt can impede our financial progress. This blog offers practical advice, examples, and empowering strategies for effective debt management and investment opportunities.

Life's a Game: Play to Win or Don't Play at All

Embrace the game of life with the boldness and strategy of a champion. This post, inspired by Jocko Willink's profound insights, is a call to arms for minority and women business owners. Understand the rules, play with integrity, and rewrite the narrative of success in your business, relationships, and personal growth. It's time to play to win or not play at all.

Cash Flow Flexibility: A Modern Approach to Personal Finance for Women and Minorities

Understanding Cash Flow Flexibility: Emphasizing adaptability and responsiveness, Cash Flow Flexibility shifts focus from traditional budgeting to a more adaptable financial management method. This approach is particularly beneficial for women and minorities, considering the fluctuating nature of their financial scenarios.

3 Essential Reasons Why a Financial Planner is Your Key to a Secure Future

Business Owners, It's Time to Get Real About Your Finances! 🌟 Discover the 3 Critical Reasons Why You Need a Financial Planner. From securing your future to facing the hard retirement savings facts, and being your emotional shield against financial mishaps – we've got you covered. Dive into our latest blog post for a no-nonsense, slightly edgy take on why a financial planner is your key to financial success.

I'm Comin'" - The Rallying Cry of Deion Sanders and What It Means for Us All

Dive deep into the powerful, motivational mantra "I'm Comin'" as coined by Deion Sanders, the new head coach of the Colorado Buffs. Understand the transformative energy behind these words and how they apply not just to football, but to leadership, business, and personal growth.

Real Talk: The Top 5 Budgeting Methods to Master Your Money Game

Cut through the fluff and get real about budgeting. Our latest blog post, 'Unleash the Power of Budgeting: Mastering Money Management with Top Methods - Black Mammoth Style,' brings you the top 5 budgeting methods with a twist. Discover how to manage your finances with the simplicity of the 50/30/20 rule, the precision of zero-based budgeting, and more. This isn't just advice; it's a financial game-changer for those ready to take control. Dive in for a bold, no-nonsense approach to securing your financial future.