Black History Month: Financial Lessons from Leaders Who Built Generational Wealth

Black History Month isn’t just a time to reflect on the past—it’s an opportunity to draw wisdom from the financial legacies built by Black leaders throughout history. From entrepreneurs and activists to visionaries who defied the odds, these figures not only shaped history but also demonstrated how to build wealth that transcends generations.

Let’s honor their achievements by learning the lessons they left behind and applying them to our financial journeys today.

Madam C.J. Walker: Entrepreneurship and Financial Independence

Madam C.J. Walker, born Sarah Breedlove, is often celebrated as the first self-made female millionaire in America. Walker built a haircare empire in the early 1900s, employing thousands of Black women and empowering them with financial opportunities.

Key Lesson: Invest in Your Skills and Community

Walker’s journey shows us that financial independence begins with recognizing and monetizing your unique skills. By building her brand and hiring within her community, she created an ecosystem of wealth that benefited others.

Actionable Takeaway:

Develop marketable skills that you can monetize.

Support and collaborate with community-based businesses to create shared wealth.

Real Talk: Walker’s legacy is proof that wealth doesn’t come from waiting for opportunities—it comes from creating them.

A.G. Gaston: Diversification and Long-Term Vision

A.G. Gaston, a businessman and philanthropist, built a multimillion-dollar business empire spanning insurance, real estate, and banking. His companies provided jobs and services for the Black community during a time of segregation and economic exclusion.

Key Lesson: Diversify Your Income Streams

Gaston didn’t rely on just one business or sector. By diversifying his ventures, he created multiple streams of income and minimized financial risk.

Actionable Takeaway:

Don’t put all your eggs in one basket—consider investments in different sectors.

Build passive income streams through real estate, stocks, or side businesses.

Real Talk: Gaston’s success wasn’t built overnight—it took years of calculated moves. Be patient, but always think ahead.

Oprah Winfrey: The Power of Ownership

Oprah Winfrey went from poverty to becoming one of the most successful media moguls of our time. Her influence extends beyond television, as she owns production companies, networks, and investments that have solidified her wealth.

Key Lesson: Ownership Is Key to Wealth

Oprah didn’t just participate in media—she owned it. By creating Harpo Productions and negotiating ownership of her show, she ensured that her financial success wasn’t limited to a paycheck.

Actionable Takeaway:

Whenever possible, own the assets that generate income (e.g., businesses, intellectual property).

Negotiate equity or ownership stakes in ventures where you contribute significant value.

Real Talk: Working hard will make you money, but owning assets will build your legacy.

Robert F. Smith: Giving Back and Building Generational Wealth

Billionaire investor Robert F. Smith gained widespread attention in 2019 when he pledged to pay off the student loans of Morehouse College’s graduating class. As the founder of Vista Equity Partners, Smith’s approach to wealth-building focuses on strategic investments and philanthropy.

Key Lesson: Invest Strategically and Give Back

Smith’s success comes from his deep understanding of markets and his commitment to uplifting others. His philanthropic efforts show that true wealth is about more than money—it’s about impact.

Actionable Takeaway:

Research and understand investment opportunities before diving in.

Give back to your community through mentorship, scholarships, or financial support.

Real Talk: Wealth-building isn’t just about personal gain. Leaving a legacy means helping others succeed too.

Jay-Z: Turning Hustle into Business Empire

From rapper to business mogul, Jay-Z exemplifies how you can evolve and expand your financial horizons. He turned his music career into a platform for launching businesses in fashion, liquor, sports, and more.

Key Lesson: Leverage Your Brand and Expand

Jay-Z didn’t stop at being an artist—he used his influence to create ventures that diversified his income and built his wealth exponentially.

Actionable Takeaway:

Identify how you can leverage your current skills or network to create new income streams.

Don’t be afraid to pivot and explore new industries.

Real Talk: As Jay-Z says, “I’m not a businessman—I’m a business, man.” Your potential is limitless if you’re willing to grow.

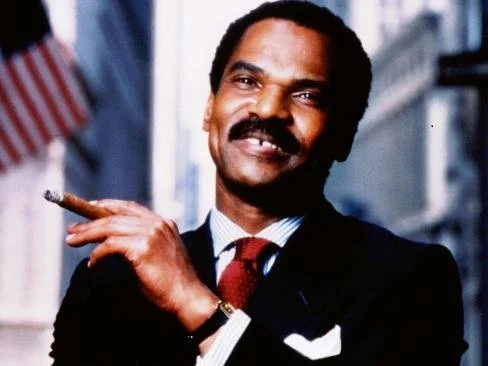

Reginald F. Lewis: Knowing When to Take Risks

Reginald F. Lewis was one of the first Black billionaires, known for his acquisition of Beatrice International Foods. His career highlights the importance of strategic risk-taking and seizing opportunities.

Key Lesson: Don’t Be Afraid to Take Calculated Risks

Lewis didn’t achieve success by playing it safe. He identified undervalued businesses and turned them into profitable ventures.

Actionable Takeaway:

Assess risks thoroughly but don’t let fear hold you back from opportunities.

Build a financial cushion to support you when taking risks.

Real Talk: Big rewards often require bold moves. Prepare yourself, but don’t hesitate when the time comes to act.

Conclusion: Learning from Legends

The financial lessons left behind by these leaders show us that wealth isn’t just about making money—it’s about creating opportunities, building legacies, and uplifting others. Whether you’re just starting your journey or looking to expand your financial horizon, their stories remind us that success is possible through hard work, ownership, and strategic thinking.

This Black History Month, take a moment to reflect on these lessons and apply them to your own financial goals. Because the best way to honor their legacy is to build one of your own.